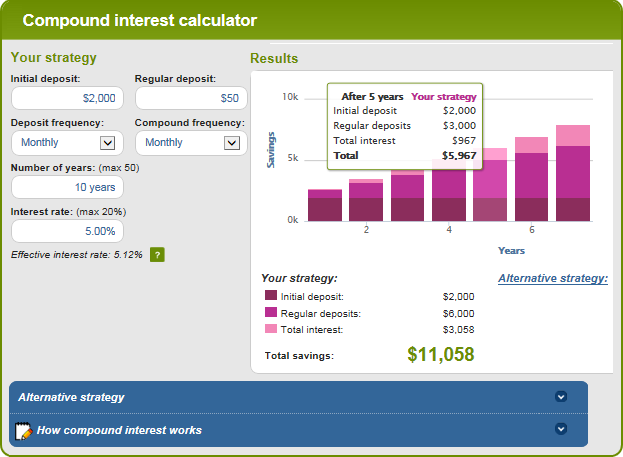

Compound interest calculator with annual contributions

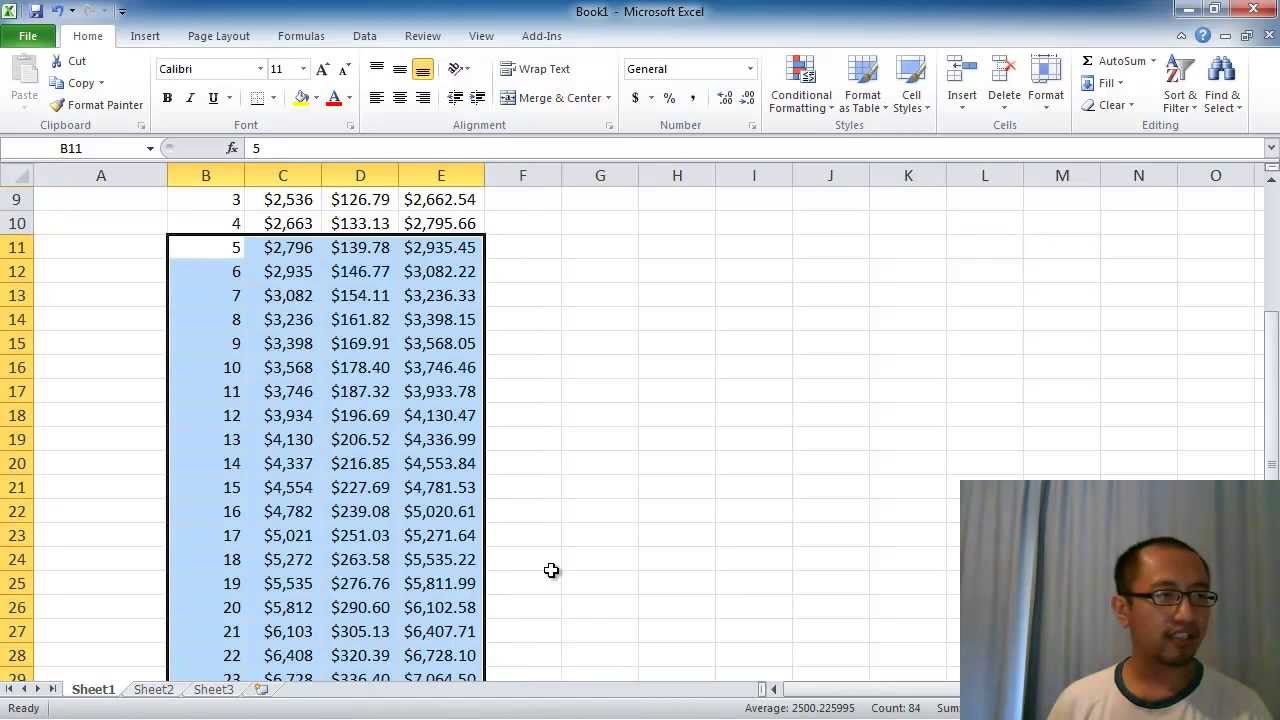

The table below shows how the calculations work each compound period. Interest rate - the rate the money grows at.

Compound Interest Calculator With Formula

Id like to know the compound interest formula for the following scenario.

. For general compound interest calculations use. 84736 1 - -7948 78001. It uses the compound interest formula giving.

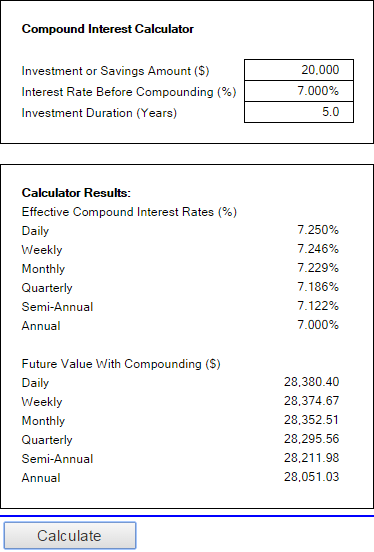

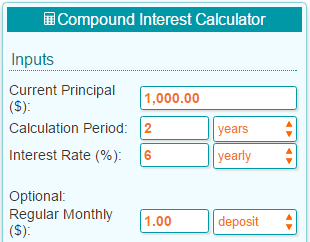

Enter the present value additional contributions if any interest rate and length of time in years below. After a year youve earned 100 in interest bringing your balance up to 2100. Search Save Online Today.

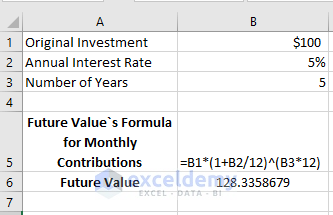

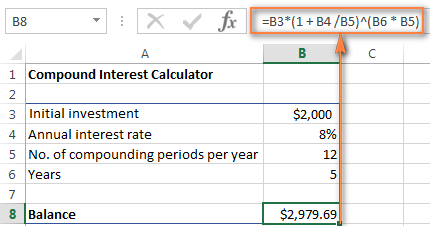

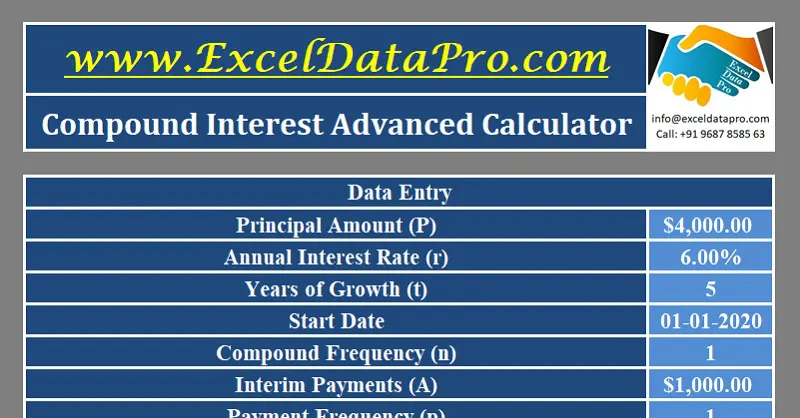

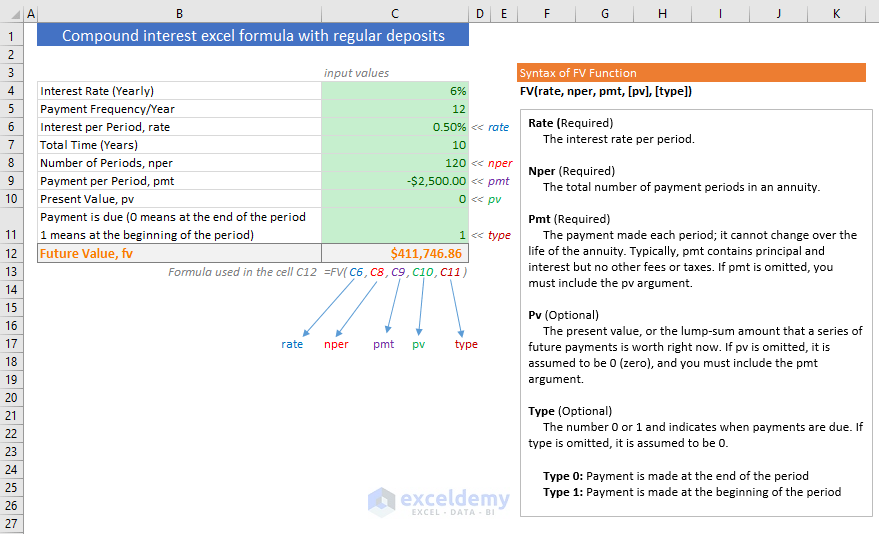

The table starts with an initial principal of P 0 4000. Compound interest calculator with annual increase Kamis 01 September 2022 Edit. The Excel formula would be F -FV 00652004000.

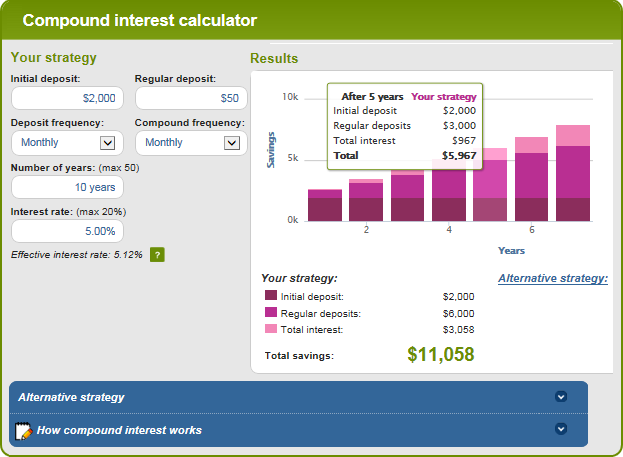

The concept of compound interest is that rather than having the interest added only once at the end the interest is added. Our compound interest calculator above accommodates the conversion between daily bi-weekly semi-monthly monthly quarterly semi-annual annual and continuous meaning. Calculate the future value of money using our compound interest calculator.

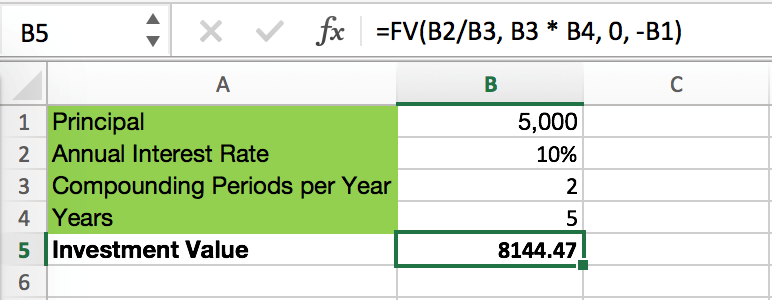

Yearly contribution double initialAmount 10000. Our simple savings calculator helps you project the growth and future value of your money over time. An investment of 100000 at a 12 rate of return for 5 years.

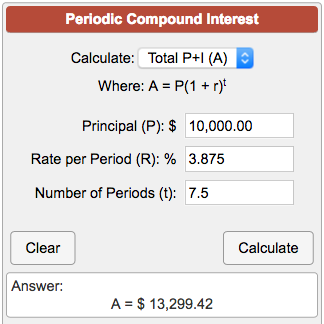

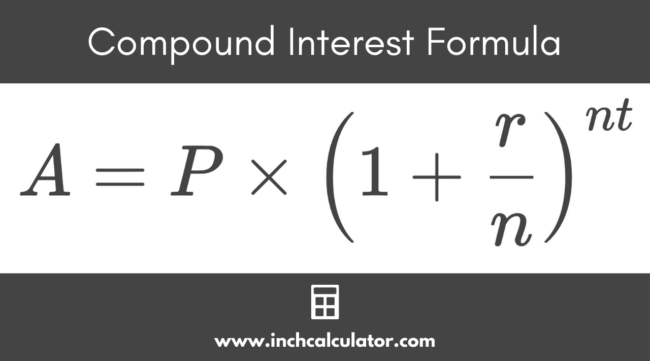

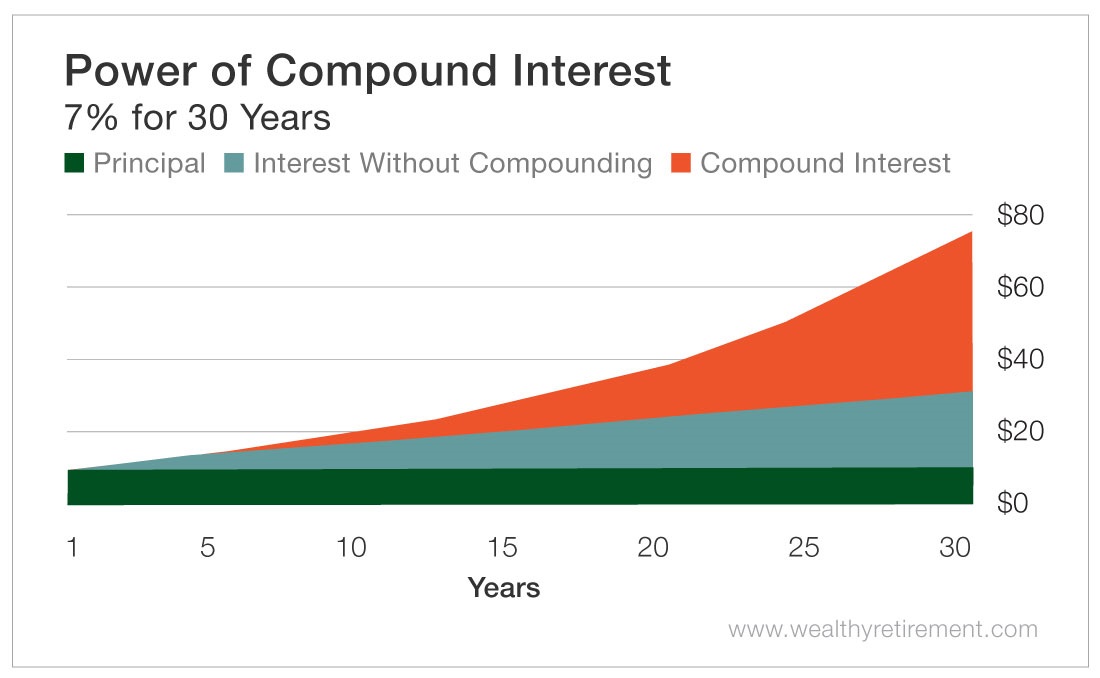

If you dont touch that extra 100 you can then earn 105 in annual interest and so on. Capitalize On Uninterrupted Compound Interest Wealth Nation. Compound Interest P 1 i n 1 P is principal I is the interest rate n is the number of compounding periods.

The formula for compound interest is A P1 rnnt where P is the. P The future value of the savings you expect to be paid in the future. To use simply enter.

Ad Find discounts on Compound interest calculator. Compound interest or interest on interest is calculated using the compound interest formula. How to calculate your savings growth.

Term - how many years to compound. Initial balance or deposit Annual savings amount Annual increase in. Compound Interest Formula And Calculator For.

Lets make the compound interest rate formula from the above expression. 92052 1 - -7948 84736. Double rateOfInterest 969.

An average annual return in a conservative portfolio with 50 bonds and 50 stocks might be 5. 10000 16 10600 x 6. Below is the compound interest with contributions formula.

P Initial Amount i yearly interest rate A yearly contribution or deposit added. Public static void mainString args double contribution 600. Use this compound interest calculator to illustrate the impact of compound interest on the future value of an asset.

Replacing 10600 with 10000 16 and 636 with 10600 x 6. N the deposits will be. 996 per anum double years.

Compound interest calculator with contributions is a tool for calculating future return on investment if you invest on a regular basis. To calculate the total compound interest generated we need to subtract the initial principal. P PMT 1 r n - 1 r 1 r Where.

How To Use Compound Interest Formula In Excel Exceldemy

Compound Interest Formula And Calculator For Excel

Periodic Compound Interest Calculator

Compound Interest Calculator Inch Calculator

Compound Interest Calculator Daily Monthly Yearly

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Calculator Set Your Own Compounding Periods

Walletburst Compound Interest Calculator With Monthly Contributions

Compound Interest Formula And Calculator For Excel

Download Compound Interest Calculator Excel Template Exceldatapro

Compound Interest Formula And Calculator For Excel

Compound Interest Excel Formula With Regular Deposits Exceldemy

Compound Interest Formula In Excel And Google Sheets Automate Excel

Microsoft Excel Lesson 2 Compound Interest Calculator Absolute Referencing Fill Down Youtube

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator For Excel

Compounded Annually Calculator Best Sale 55 Off Www Ingeniovirtual Com